Since Jan 1st, we've moved up from 1260 to 1350 with almost no major selloffs. That's almost a hundred points in a month. I traded the rally on the bull side, and have handily beaten the averages. As such, I continue to be bullish -- long until wrong, as they say.

However, I am currently extremely light. In fact, I hold only one open position. As I currently have cash I am looking to put to work, I would like to take a minute and go over a few possibilities.

First, let us review the largest reservoir of cash, the long bond. Here is the situation as I see it.

While bonds are showing some short-term strength on the expected bounce off the volume pocket directly below, I believe the TLT is headed lower. It may bounce -- ideally to the top of the descending channel -- but should it crack the volume pocket below, we prices should drop rapidly. This will mean that a very large amount of liquidity will pour into the markets, and is definitely something to watch for. Ideally, while loaded to the gills with calls on high-beta stocks.

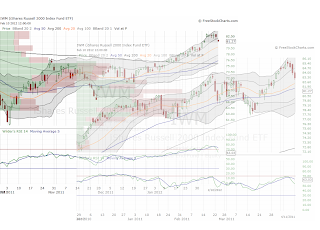

Speaking of high-beta stocks, let us consider equities. An interseting study is IWM, with an overlay from this time last year.

Here, we see about a month of choppy, difficult trading slowly grinding downwards for about a month. For swing traders, this is incredibly frustrating.

Most of the down opens are met with buying, however. And even though the market did trend lower, buying the dips continued to work -- albeit with shorter timeframes. Having muddled through this market before, we have the tools to deal with it, and will grin and bear it should we see it.

Next, consider what I personally consider an ideal situation: The quick, sharp pullback. Erik Swarts demonstrates this best in his latest missive, Seat Belts.

The percentages Erik's study shows would call for a very rapid pullback putting us close the levels we saw at the beginning of the year. While I would not put that past the realm of possibility, that does mean that we get some quick bloodletting, which will put us back around the 1250 - 1270 mark.

...in which case, we still buy the dip.

So, we have three scenarios:

- Should we grind higher, we continue to buy the dip.

- Should we grind, we buy the dip.

- Should we drop quickly, we buy the dip.

As I write this, Athens is burning. People are being massacred in Syria. The Iran/Israel situation is deteriorating by the minute. Honestly, as through 2011, this continues to be the most depressing news cycle I can remember.

However, from a market perspective, it is clear that there is a strong bid. Call it manipulation, cry foul or cry uncle, every dip has been shallow, and has been aggressively bought. The casual study I have outlined above shows that staying long seems to be the way to go for now.

In the end, trading well is... about trading, about executing where the rubber meets the road. The price action I have seen since January has given me no reason to go short. Until it does, I will continue my long bias, buying the dips and trusting my stops to tell me when I'm wrong.

As I said earlier, long until wrong.

No comments:

Post a Comment